The digital coins market is developing at a frantic pace, new directions and cryptocurrencies are emerging that reach incredible volumes. This attracts new crypto enthusiasts who want to make a fortune in digital assets or at least become successful traders. However, as a rule, beginners need to gain experience in order to earn on crypto assets. It is important to pay attention to security issues and how to make crypto trading safe. One of the ways to gain experience is to explore different platforms and projects in the crypto market. By learning more about Compound finance review and other platforms like it, you can gain valuable insights and knowledge about the crypto market and how to make your trading more secure.

In this article, we will pay great attention to how to trade cryptocurrencies safely and understand what affects the price of a digital asset. To begin with, where is the best place to trade digital assets? A centralized crypto exchange or CEX is the most secure way to trade digital assets. Centralized companies are regulated by law and are legally responsible for the safety of your capital.

In recent years, the DeFi sector has made a significant leap. Due to this, trading on decentralized cryptocurrency platforms or DEX has become very popular. When trading on the DEX, the user retains full control over their funds through the use of a third-party wallet. Also, transactions through the DEX are anonymous due to the fact that all information is stored in the blockchain. But the DeFi sector is practically unregulated, and therefore only users are responsible for the safety of their capital.

Now it’s time to find out what can make a difference to digital asset capitalization. It is important to understand that crypto is a new financial instrument that has absolute independence from centralized structures, such as state governments or financial organizations. All digital assets operate on the blockchain, and it makes them more safe and usable. But the question arises: if cryptos are decentralized and safe, then in which way do they form their capitalization.

Types of cryptocurrencies

Here it is necessary to distinguish two great different ways to the formation an interest in digital coins. The first approach is based on the fact that the price of a coin depends on its ability to be used as payment for goods, services, or new opportunities for cross-border transactions. This group of crypto assets includes Bitcoin, XRP, and Cardano. The second group of digital currencies was formed quite recently and lies in the fact that the value of a coin forms the possibilities of its ecosystem. The most famous representatives of this group are Ethereum, Polkadot, and Solana.

The value of a particular cryptocurrency asset may change based on fundamental economic and geopolitical processes. For example, in the development of metauniverses and augmented reality technologies, NFT technologies are used. Ethereum is the largest platform for the development of non-fungible tokens in the industry, and therefore receives the greatest dividends from the development of the industry. The second example is based on the current geopolitical situation. The war in Ukraine and all-out sanctions against Russia made investors fearful, and they began to use Bitcoin as a hedge against subsequent economic shocks.

Bitcoin’s influence on the crypto market

But let’s take a closer look at Bitcoin. The fact is that this cryptocurrency has a market cycle: growth, correction and accumulation. However, due to space capitalization, BTC has a huge impact on the rest of the market. Therefore, when the price of BTC falls, the entire digital assets market suffers. This is due to the fact that the share of bitcoin dominance in the total capitalization of the digital coins market is more than 42%. Therefore, the main digital asset must be taken into account as a factor affecting the value of a digital coin.

It is important to note that this also works in reverse. That is, if the dominance of Bitcoin falls, then the so-called altcoin season index rises. Usually, when BTC dominance falls below 40, the rest of the cryptocurrencies begin to actively grow and update their historical or local highs.

Fundamental factors

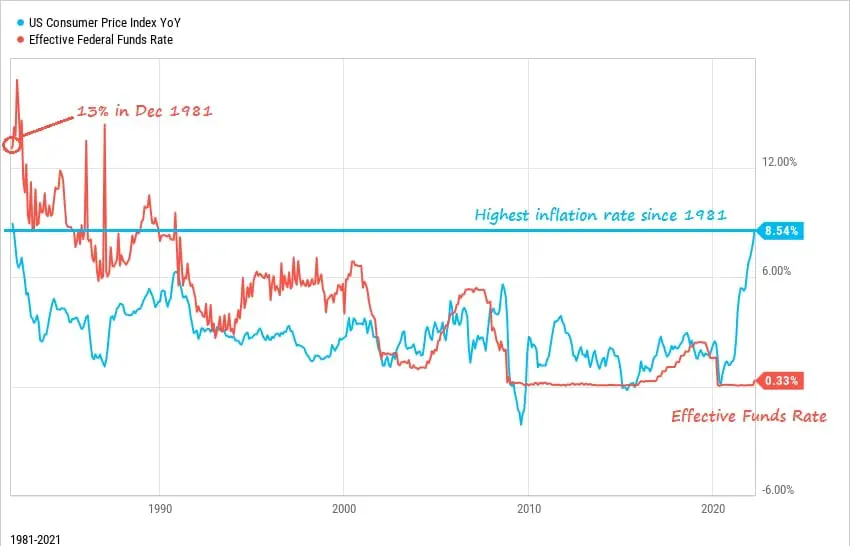

We mentioned the war in Ukraine and Western sanctions. This is also an extremely important factor affecting the quotes of crypto assets. Such global events are called fundamental, as they are so large-scale and influential in nature that they are necessarily reflected in the crypto market. For example, take the coronavirus crisis: the US announces a stimulus program. Or in other words, launch a money printing machine. The market is filled with money and digital coins also receive their share of liquidity depending on the demand for their functions.

But a year later, it turns out that the inflation rate in the United States has reached a record level over the past 30 years. And the FOMC is forced to launch a quantitative reduction program, which indicates a decrease in liquidity in the market. And accordingly, the less liquidity, the less capitalization and cost of digital assets. And accordingly, the less liquidity, the less capitalization and cost of digital assets. And in such a situation, not only the crypto-currency market suffers, but also other sectors of the economy. But the event is so large-scale that it affects all spheres, and therefore it is called fundamental. To stay informed on these events and news, you can check tradecrypto.com for updates and analysis on the crypto market.

International regulation

Separately, it is worth highlighting the factor that hinders the development of the industry. The lack of state or international regulation of cryptocurrencies reduces the level of investor involvement. Many large companies are reluctant to invest in the digital asset market without security guarantees. It is likely that this gap will be closed soon, but for now it is an important deterrent that negatively affects the value of digital coins.

Cryptocurrency Development

We conclude our selection with more local reasons that affect the value of cryptocurrency. It should be noted that this mostly applies to projects that develop their own ecosystems. To support the increased demand for the coin, the development teams publish road maps and updates that improve the performance of digital money algorithms. In addition to real improvements, this creates the appearance of a rapid and constant development of the project. Due to this, investors see more prospects in a particular coin and try to invest more in it.

All these facts are key in the analysis and development of investment strategies for investing in crypto assets. You need to pay attention to these factors both in active daily trading, and for passive accumulation and long-term HODL. The applicability and importance of factors influencing the cryptocurrency market is especially important given that the digital assets market is a young and volatile institution. This suggests that if you do not follow the main components of the impact on the price, then you can lose most of your capital. Analysis of the key components of the impact on the price of a digital coin is a defining component of successful investment activity in the digital coins market.

Jusifer Longdale is a crypto journalist who loves to write about all things blockchain and crypto-related. She is a firm believer in the power of these technologies and their ability to change the world for the better. In her spare time, she enjoys reading, hiking, and spending time with her family.